It's been over a year since Longfields launched a Financial Services offering in conjunction with Independent Financial Adviser Neil Walker of 2plan wealth management Ltd. With 2023 well underway, we caught up with Neil to look back on how he has assisted our clients with their financial planning over the past 18 months.

Whilst each client may have different needs, Neil tells us in 2022, there were four key areas that clients discussed with him. Below, we take a look at what these were:

Since the Financial Services offering began, approximately 30% of our cases have involved offering financial protection for loved ones. An area which Neil is finding more and more people being acute to. Not only in terms of the requirement to protect against the breadwinner's premature death but also the need to replace lost childcare provisions and important tasks at home. These are all seen as vital should the worst happen to a parent in the family.

Alongside obtaining life cover, many clients are becoming more aware of the need to protect against serve or critical illness. We have seen approximately 40% of our protection cases making provisions for this as well as death. This need is all too easily reflected when we consider Macmillan’s latest research, which suggests that as many as 1 in 2 of us will be diagnosed with cancer during our lifetimes. Having a financial response to such a diagnosis can at least soften the financial blow of such life-changing news, allowing you to focus on recovery without the additional worry of finance.

Our 'A New Tax Year' blog, which launched in spring 2022, remains the main area of focus for enquiries, and we'd actively encourage you to read this. In the blog, Neil talks about making full use of the tax efficiencies offered by ISAs and Pensions, as well as ensuring that current plans match a client's current needs, views, and circumstances. In fact, more than 50% of our cases since January 2022 involve using an ISA or Pension solution.

Looking back on what has been one of the most turbulent years for financial markets in some time, simply providing a regular and reliable face-to-face review service is hugely important to allow clients to keep things in perspective. Neil finds that just being there to hold his client's hand as fund values fluctuate is one of the most important parts of an investor/adviser relationship. The emotive desire to 'cut and run' as markets decline is most natural for many clients. By removing emotion from the equation, clients can focus on their original investment goals while ignoring all the noise. Regular reviews of asset classes, portfolio makeup and a client's risk attitude enable us to ensure that the client remains on track for their goals. By far, the majority of Neil's meetings are spent completing reviews of current holdings.

Be it by making pension contributions funded by the employer or by the use of Relevant Life as a highly tax-efficient method of protecting the family, reviewing family-owned companies has increased in popularity. Of those life cover cases previously mentioned, 30% have been funded by a Relevant Life plan, which means that the business can offset the cost of family protection as a business expense, leading to large tax savings. In our blog 'Let Your Business Take the Strain', Neil talks about the benefits of Relevant Life and why business owners should explore this as part of their personal and business financial arrangements.

As 2023 gathers momentum, early indications suggest these four main focus areas, along with Inheritance Tax issues, remain top of the list for Longfields clients.

If you would like to discuss your financial planning and find out how Neil can assist you, please speak with your Longfields Account Manager, who will put you in touch with Neil.

Neil Walker is an adviser at 2plan wealth management Ltd.

2plan wealth management Ltd is authorised and regulated by the Financial Conduct Authority. It is entered on the FCA register (www.fca.org.uk) under reference 461598. Registered office: 2plan wealth management Ltd, 3rd Floor, Bridgewater Place, Water Lane, Leeds, LS11 5BZ. Registered in England Number: 05998270

Tax planning is not regulated by the Financial Conduct Authority.

Longfields, we’re more than just an insurance brokerage. We firmly believe in networking and assisting our customers and local businesses wherever possible.

Our Managing Director, Luke, is a loyal customer of Fodder, a local Butcher Shop and Deli, based in Melton, Woodbridge. With Christmas only a few weeks away, we called in to see one of the owners, Harry, to learn more about them and why local support is vital to their businesses.

When was your business established in our local community, and by whom?

We took over a long-established local business in May 2022. Our background in food was based in producing scotch eggs for the likes of Harrods, Selfridges and Fortnum & Mason. We decided to take on a retail outlet and have our own customer-facing place to showcase our food creations.

Are you a family-run business?

I run the shop with my brother, Jack. He is more hands-on in the day-to-day running of the shop and is responsible for bringing in all the wonderful deli products you see in there. My role is more focused on the creative side and the painful admin!

How were you affected by the pandemic closures?

Our takeover was post covid restrictions, so luckily, we missed that, but the previous owners did incredibly well over those years as the local communities around the country dug deep to support local, which is just brilliant.

What does your business mean to you personally?

My business is my everything. It gives me the chance to provide people with the food that I truly believe in. A chance to educate people on more sustainable ways of eating meat and working with small producers to showcase their amazing products. It’s fraught with highs and lows and is so personal as we put every waking hour into being the best we can be, but the highs far outweigh the lows for sure.

Where do you see the future for local butchers, and why?

I think butchers have a tricky future, but if done right and focused on important subjects like sustainability, I think they can do really well. I’ve always been an advocate for eating less meat but eating good meat. So not eating meat twice a day from a supermarket but eating local, regeneratively farmed meat a few times a week instead.

Why is local support so important to your business?

It’s vital for us to gain support from the locals. We’re up against the supermarkets, which from a pricing point of view, we just can’t compete. We do, however, beat them on quality by a mile. We work tirelessly with other small businesses like ours who are championing more sustainable and regenerative farming methods and producing high-quality products from which we curate a perfect selection for our loyal customers. It’s a David vs Goliath battle that we believe we can win because we have a b etter offering that serves the public with a more conscious choice.

A big thank you to Harry at Fodder’s for taking the time to speak with us, especially during the busy festive season. To learn more about Fodder’s, head to their website and visit their social media channels.

In this blog, written by Independent Financial Adviser Neil Walker, Neil looks at how your business could take the strain as cost-of-living rises.

As interest rates rise and the cost of living seems to increase daily, finding ways to save money are more important than ever. This is certainly the case for small business owners who, more than most, are feeling the pinch of the cost of living from both the professional as well as the personal side of life.

As more of the population are now working for themselves via their own limited companies, many small businesses are missing out on the tax savings available by letting their business provide for their families by way of life cover through an underutilised and often overlooked product called Relevant Life.

Relevant Life is a tax efficient way for businesses to offer life insurance (death in service benefits) to their employees on an individual basis. In the case of many small businesses, such employees will also include the business owners such as Managing Directors as well as other family members. It therefore allows the business to take advantage of the tax efficiency usually enjoyed by larger companies with larger workforces.

In simple terms the employer provides an individual life cover policy for an employee that pays out a lump sum if the life covered dies during the policy term. The employer being the policyholder, the employee being the life insured with the policy being written in trust to provide the benefit for the employee’s chosen beneficiaries.

As Relevant Life is written on an individual basis, small business owners can take advantage of the tax efficiencies generally enjoyed by large companies by covering themselves should they be employed by their own limited company.

Please note that the provision is for an employee or employed Director so this style of provision is not suitable for self-employed or partners.

The benefits of purchasing life cover via relevant life are best seen when looking at the net cost of purchasing life cover for an employee through the relevant life plan when compared to a standard individually purchased life cover policy.

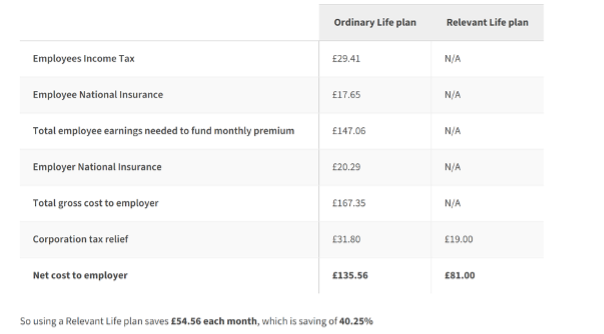

Worked Example

Assuming a £100 monthly premium for an employed Director of a limited company (basic rate tax payer).

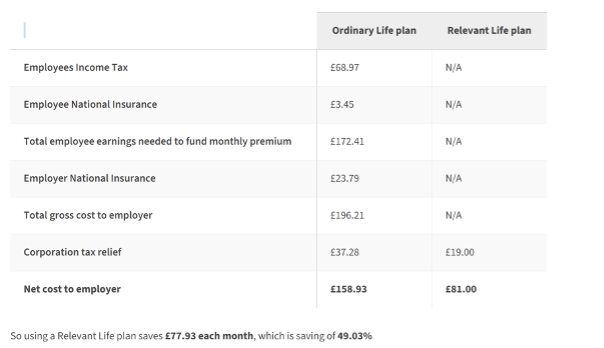

The results are even more pronounced for a high-rate tax payer as follows:

The benefits of Relevant Life can offer large savings to many employees and small business owners and are certainly well worth exploring as part of both personal and business financial arrangements. As with many areas of financial advice, there are many providers offering different options for Relevant Life protection. In order to gain the best policies for your needs I would strongly recommend the use of a professional and independent financial adviser.

If you are concerned about the provision for loved ones as well as ongoing costs, Relevant Life may offer peace of mind as well as the savings needed to help with these uncertain inflationary times.

If you wish to discuss Relevant Life with Neil or would like to talk about your financial planning, please speak with your Longfields Account Manager, who will put you directly in touch with Neil.

2plan wealth management Ltd is authorised and regulated by the Financial Conduct Authority. It is entered on the FCA register (www.fca.org.uk ) under reference 461598.

Registered office: 2plan wealth management Ltd, 3rd Floor, Bridgewater Place, Water Lane, Leeds, LS11 5BZ.

Registered in England Number: 05998270

A New Tax Year, A Great Time to Focus on Your Finances

In our personal lives, tradition dictates that the beginning of the New Year is a great time to focus our resolve on those things we wish to achieve in the coming year. Similarly, the new financial year, which starts on 6th April, is a great time for us to consider the goals in our financial lives to ensure that we are on track to meet our expectations and dreams.

From the good housekeeping of ensuring that we consider the use of various annual allowances at the earliest opportunity, as well as looking at the potential of maximising the tax relief, particularly for those paying higher rates of income tax, the benefits of regular annual reviews means that we have a far better chance of remaining on track by putting best practices in place early in the tax year rather than the annual rush not to miss deadlines which is such an unfortunate feature of the financial advice industry.

A strong financial review is about ensuring that we have the right money in the right place at the right time.

Protecting ourselves and our loved ones is always the first consideration of a solid financial plan. Only by having a firm foundation on which to base our financial objectives can we ensure that our plans are achieved should misfortune strike.

Reviewing one’s position in terms of the “what happens ifs” is something we should perform regularly. The potential of job moves, particularly following the pandemic, means the protection we thought we had provided through our employers may have changed significantly. Making sure that our financial provision is robust enough to deal with the potential loss of income caused by a long-term sickness or the financial shockwave caused by an unexpected dread illness and in the worst-case the financial devastation of premature death are, considered, discussed and costed and suitability of current provision is assessed and renewed where necessary.

Another side effect of the pandemic is the increase in the number of people venturing into self-employment or starting their own small businesses. By implication, the historical comfort blanket of employee benefits provided by traditional larger employers is now far less protective to many and the need to review protection is something which can easily be missed through the hectic days of starting out on such business ventures. There are tax efficient methods of protecting people in their own businesses which may well have been missed. A financial review can ensure that we remain up to date with such opportunities.

Away from this important, yet often shied away from area of protection, regular assessment of the existing investment and pension holdings is a huge benefit of regular reviews. Assessment of an individual’s current ‘attitude to risk’ for specific objectives as well as looking at the charging structures and benefits provided by existing policies, is a valuable part of the review process. I have lost count of the number of people who are invested in pension and investment funds that were initially chosen many years ago when the investor was at a very different stage of life than they are today. By regularly assessing an individual’s risk tolerance and reviewing the appropriateness as well as performance of one’s holdings, we should be in a far better position to plan and achieve our retirement and other investment objectives.

In summary, the benefits of a regular review with an independent financial adviser can be seen as ensuring our provision against the worst is up to the job whilst vastly increasing the chances of achieving the financial goals and dreams we have worked so hard for.

As an independent adviser I will conduct a fair and unbiased analysis of the market in relation to your personal needs should the need arise. There is no time better than the New Tax Year to start to plot the course for our financial futures.

Happy New (Fiscal) Year!!!

Neil Walker, Independent Financial Advisor

Neil Walker, Independent Financial Advisor

Please note, the value of investments can fall as well as rise and you may not get back the amount originally invested. The FCA does not regulate tax planning.

When it comes to buying agricultural, commercial or personal insurance, tapping into the expertise and experience of the Longfields team can be a smart move.

If you're running a business or need cover for high-value personal assets, finding an insurance policy that meets your needs can be challenging and time consuming. It's not just about the headline price. It's about making sure that you're adequately covered and that you won't find yourself less than satisfied if you need to make a claim.

There is an easier solution: get in touch with Longfields. As an insurance broker, we can offer you a range of benefits which speak for themselves.

Personalised service

As a broker, we aren't tied to any one insurance provider. That means you get choice, flexibility, price competitiveness and impartial advice. We work with an extensive network of trusted insurance companies, so we can offer you a policy that's perfectly tailored to the needs of your business, whether you're running a farm, an SME or a large corporation. We can also provide bespoke solutions for private clients, with cover for all kinds of valuable assets, from art and antiques to property, private yachts and more.

You'll also benefit from continuity. Your dedicated account manager will get to know you and will be with you all the way, from discussing your needs through choosing your policy to making a claim if necessary. So, you don't have to worry about dealing with a call centre or being passed from one department to another.

Save time and hassle

The insurance marketplace is increasingly complex and finding the right policy can take a lot of effort. Why spend time comparing cover and benefits when you can leave that to a broker and focus on running your business or looking after what really matters?

Get the right cover

As a broker, we start with your requirements, not ours. For example, you may have unusual or complex business activities or high-value, high-risk assets. That means we can find you a policy that delivers exactly what you need.

Whilst, of course, price is an important factor and we can be very competitive, in equal measure, we spend time to thoroughly understand your business to ensure your policy reacts should you suffer a loss.

What's more, your policy does not have to automatically renew year on year. You will have a dedicated Account Manager that can come and visit you on your premises, or telephone you if you prefer, to carry out a full renewal review in advance of your policy expiring.

Peace of mind

If the worst happens and you need to make a claim, it's reassuring to have the support of an insurance professional to guide and support you through the process. We pride ourselves on putting excellent customer service at the heart of everything we do. Insurance claims can be complex and we use our expertise and experience to ensure your claim is settled as quickly and efficiently as possible.

Remember, you will always have your dedicated Account Manager at your disposal.

The Longfields promise

We're committed to delivering high-quality, price-competitive insurance solutions tailored to your needs, along with the highest standards of personalised customer service.

With over 50 years' combined experience, our friendly, proactive team offers specialist knowledge and experience in agriculture, commercial and private client insurance.

A bit more about our team

In our agricultural department, members of the team are also closely involved in community and charity work, giving them an insight into the unique challenges facing farmers in today's world. For example, one of our Farming Account Managers, Jill Girling, volunteers for the Royal Agricultural Benevolent Institution (RABI), sitting on the committee and helping with the organisation of events and fundraising activities. Our Agricultural team have also completed mental health training with YANA, which supports those involved in farming and other rural businesses affected by stress and depression.

Of course, farming is not our only area of expertise. Our commercial team has extensive knowledge across a range of sectors including, but not limited to haulage, construction and property owners, manufacturing and wholesaling, retail….. the list goes on!

Now's the time to discover the benefits of using Longfields. Whether you're looking to renew your policy or simply want some advice, the team at Longfields will be happy to help. You can contact us on 01473 784500 or 01206 396000, info@longfields.co.uk

Rural law-breaking may have been pegged back by the pandemic, but it hasn't gone away. With perpetrators becoming more devious and new worries such as online fraud, farmers must stay one step ahead and be proactive to keep their property and assets safe and secure.

Rural crime remains a significant challenge across the UK. While the COVID-19 pandemic restricted the activities of criminals, with numerous lockdowns, the problem hasn't gone away.

The cost of theft runs into tens of millions, with many of the victims of rural crime being farmers and landowners whose livelihoods continue to be regularly impacted by theft of machinery and livestock, malicious property damage and other illegal acts.

New trends

Tactics and types of crime seem to be evolving. Thieves are thinking bigger, with high-value items such as smart technology, quad bikes and all-terrain vehicles (ATVs) being specifically targeted. As many council refuse sites closed down or became more difficult to access during lockdown, fly tipping increased. And with a huge increase in dog ownership over the past eighteen months plus more staycations and visits to the UK countryside, attacks on livestock have risen sharply. Theft of working dogs is also a growing concern, with some farms losing several animals at a time.

New technology is also helping criminals be more effective. Gangs known as 'rural wraiths' are using super-quiet e-scooters to sneak onto farms. They steal valuable items, such as GPS equipment, then shoot off into the night with hardly a sound. Costing anything from £4,000 to £10,000 or more, GPS technology is an essential tool in modern farming and the impact of being without a vital piece of kit, even for a few days, can be significant, delaying essential work such as harvesting.

To guard against GPS theft, some farmers remove the devices and store them securely at night. But if you do this, it's worth checking your insurance policy. Some insurers don't provide cover if the equipment is not attached to the vehicle and the loss may not be covered under your Motor Insurance Policy, while other insurers arrangements may also not pick up the loss. If your GPS devices carry security codes, we’d recommend using them, and where possible, mark them with a security mark or even your postcode.

Online threats

Like anybody else in today's digitally driven world, farmers can also fall victim to cybercrime. Online criminals are becoming ever-more devious and, when you're logging on to your computer at the end of a tiring day, it's easy to be caught out by a phishing email or banking scam. The golden rule is to treat every communication you receive with care and think before you click.

A hidden problem

A crime that can often sneak under the radar is hare coursing. Despite being banned in 2004, it remains a costly and distressing problem for thousands of farmers, across the UK. Not only is it a cruel blood sport, it can cause major damage to crops, fences and gates. The internet has helped turn it from a poacher's pursuit to a serious online gambling and entertainment business, with encryption allowing coursing activity to be livestreamed to spectators.

Whilst perhaps a less known element of rural crime, its awareness in the Eastern region has recently seen a surge, with local police forces joining together to tackle the issue.

Focusing on prevention

While agricultural crime can sadly seem like an inevitable occupational hazard for farmers, there are several measures you can take to assist in protecting your property, land and livestock.

Making things difficult for criminals can be a simple deterrent. Whilst not an exhaustive list, this can include having robust padlocks on gates, blocking unauthorised access to fields and woodland, installing security lights with motion sensors in yards and drives, and ensuring vehicles are locked and the keys removed, even if you're only leaving them unattended for a short period of time.

It's also a good idea to keep details of all your vehicles and other valuable equipment in a safe, convenient place. Take pictures of them and record their serial numbers, so that you have all the info at hand in case of a theft.

Smart security

With advances in technology, more sophisticated security equipment is now relatively affordable. A professionally installed CCTV system with infra-red cameras and an alarm system linked to your mobile phone is the premium option, but there are also entry-level DIY kits available for just a few hundred pounds. Some of the more expensive systems feature the option to have ANPR camera technology which will record vehicle number plates.

To help with reporting crime, it's worth considering downloading the what3words app, which can help save time in identifying your location to emergency services.

Peace of mind

Whatever safeguards you put in place, unfortunately there's always the risk that you'll fall victim to agricultural crime. That's why it makes sense to have comprehensive insurance cover in place and give yourself peace of mind. At Longfields we have strong roots in the farming industry and specialise in providing insurance solutions tailored to the needs of today's farmers. We work closely with clients to make sure they have the right types and levels of cover in place, and we can also provide valuable advice and suggestions on security and crime prevention.

Speak to us today on 01473 784500 or 01206 396000 and find out how Longfields can help you.

With over 50 years of combined experience, we have the expertise, knowledge, and marketplace to present competitive insurance deals, both in premium and cover.

Delivering insurance solutions across Cambridgeshire, Essex, Norfolk and Suffolk, the Longfields team has strong roots within the farming and agriculture industry. Our team has over 50 years of combined experience, and it's this experience that means we don't just understand insurance; we know farming too.

Luke, our Managing Director, knows that delivering a good old fashioned first-class service with a quality insurance solution for our farmers is key, and this is an ethos that runs throughout the company.

It's not just agriculture insurance we do; we also offer commercial and private clients insurance, making sure your life's most valuable assets are covered.

You'll find our office in rural Suffolk, in a village called Otley. We've set up home in an old barn, which has been developed into an office space, and we have stunning views of farmland all around us.

Our team has a real passion for farming. Jill, one of our Farming Account Managers, was, in fact, born into a farming family, meaning she knows first-hand what life is like on a farm and the key months in a farmer's life. Jill channels this knowledge into her 30 years of experience within the insurance industry to deliver suitable insurance deals for her farmers.

Mark, another of our Farming Account Managers, has been with us since the beginning. He has over 18 years of experience and knows everything about farming insurance. He's very particular and will scrutinize your policy to ensure you're on the right insurance programme for your needs.

We believe that it's not only about insurance; it's about people, building relationships and helping our farmers out wherever possible. Mark has often been a farmer's right-hand man while out on site visits. During lambing season, he once helped a farmer deliver a lamb, and he's been witness to a field fire, in which he alerted the farmer and fire brigade.

We have access to a broad range of insurers, meaning we can find insurance policies tailored to your needs. We offer impartial advice and have the expertise required to arrange an insurance programme that works for you. Whether you're looking for combined farm insurance for your family farm, agribusiness, or smallholding, we can help. Plus, when you sign with Longfields, we'll never let your policy automatically renew. We will review your policy and needs ahead of your renewal date to ensure it's still relevant and you will remain on the right policy.

Take the hassle out of finding your next insurance policy, and let us do it for you. Whether you're looking to renew your insurance policy or want some advice, the Longfields team would be happy to discuss your requirements. You can contact us on 01473 784500 or 01206 396000.

According to the HSE there are about 65,000 non-fatal accidents in construction in the UK each year. Managing risk in construction to avoid accidents and getting the right cover in place is therefore essential. Longfields is an independent broker to the construction sector. We offer the wide range of policies needed to cover the building industry and associated trades. In this article we explain some of the main policies that are needed in the sector and how we at Longfields can help to reduce risk.

Who needs it? Employers, the principal contractor and subcontractors.

What does it cover? It covers the insured business for physical injury to third parties or property damage which arises in the course of the business’s daily activities, such as damage to a client’s property or a neighbouring property whilst the insured is undertaking work. It is becoming more common for contractors to be asked to have enhanced limits for their Contractors Liability Insurance and we provide Public Liability limits from £1m to over £10m.

Who needs it? It is a legal requirement for all employers within the UK to hold this cover and the minimum statutory limit is £5,000,000 although most insurers provide £10,000,000 automatically.

What does it cover? It covers the business for liability arising from employees (including temporary workers and labour only subcontractors) who sustain an injury or illness during the course of their work. Bona-fide subcontractors need to have their own insurance in place and main contractors must ensure that their bona-fide subcontractors have this in place or the main contractor will assume the sub contractor’s liability themselves. Bona-fide subcontractors will usually need to carry insurance to at least a minimum level that is set by the main contractor’s insurers.

Who needs it? The employer, the principal contractor and subcontractors

What does it cover? The insurance protects against physical damage to works and site materials that the insured business was contracted to undertake. It covers the works in the course of construction before it is handed over to the principal contractor or employer on practical completion.

There are several elements that this kind of insurance covers, most of which are out of the ordinary from other kinds of insurance. Contractors All Risks insurance can be seen as an additional kind of insurance that you would purchase if you are working on construction sites, since a traditional Public Liability insurance policy doesn’t cover any damage to the work on site, or any hired-in plant or equipment.

It can pay to repair or re-do the work that is in progress if its damaged by an insured event and includes both permanent and temporary works. Importantly though, it does NOT cover poor workmanship or wilful negligence by the insured (or the insured’s sub-contractor).

Who needs it? Anyone who provides advice or has design responsibility, even if this is subcontracted to another party.

What does it cover? Professional Indemnity covers legal costs and damages including rectification costs in relation to alleged errors in the design or the construction of project. Here it is vital that contractors take great care in ensuring they do not inadvertently take design responsibility that is rightfully the employer’s or the architect’s. One common pitfall is when a section of the works has CDP (contractor’s design portion). We have experience with this and can provide specialist advice.

Who needs it? Any business with motor vehicles (including farm vehicles).

What does it cover? Motor fleet Insurance is designed for businesses with multiple vehicles, to have them all on one policy. Whether they’re cars, vans, minibuses, trucks or HGVs, there are three levels of cover to choose from - Comprehensive, Third Party, Fire & Theft and Third Party Only. You can also choose to have a policy covering any driver to drive any vehicle, or fixed to Named Drivers for specific vehicles.

Fleet insurance provides cover to the driver, passengers and third parties for injury and physical damage caused. Staff who use their own vehicles in the course of their work (where movement between building sites is common), need to be adequately covered for their motor use (either on their own personal motor policy with a business extension or on the company’s motor policy).

Who needs it? Any director or controlling person in a business.

What does it cover? Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers (and their spouses), in the event they are personally sued by employees, suppliers, competitors, investors, customers or other parties, for actual or alleged wrongful acts in managing a company. It is particularly relevant in high risk sectors such as construction. The cover is valid even if their company becomes insolvent. Care should be taken to ensure that the actual D&O policy taken out covers the specific risks that need to be protected (eg employment practice claims which are not always standard in D&O policies).

We also offer other types of insurance cover.

Our range of cover comprises all the major policies (explained above) and we also help with:

We all know that farming is a hazardous occupation. The industry represents approximately 1.8% of the workforce in Great Britain but accounts for about 19% of the reported fatal injuries each year. The four most common types of accident on farms involve vehicles and machinery, falls from heights, lifting and handling and hazardous substances. The rate of self-reported illness in agriculture is also significantly higher than the average for all industries.

The chance of problems occurring can be reduced with careful attention to the health and safety rules that govern farming. Doing so can significantly help reduce the personal, social and financial costs of accidents.

Some of the main areas of health and safety risks in farming are found in:

These risks can be alleviated very significantly if health and safety risk assessments are undertaken and then followed in practice. Agriculture has a good number of migrant workers whose first language may well not be English. This is where training and induction is so important. In the event of an accident or emergency then knowing the procedure to follow can get help quickly. Farm workers are often fairly isolated and so the need for proven emergency procedures is all the more vital.

At Longfields we work hard with our clients to ensure risks are understood and then mitigated as far as possible. There is a lot of relevant advice available to help avoid incidents and the Longfields team has a wealth of experience in farm insurance and identification of risk. Although we pride ourselves on supporting our clients pro-actively when a claim arises, it is much better if a claim never happened in the first place. The primary purpose of good risk management must be to ensure that nobody is killed or injured on our farms. A welcome secondary benefit is it helps to keep premiums down!

Mark Whyman

01206 396000

www.longfields.co.uk

With the current heatwave predicted to last, there is an increased risk of wildfires such as the ones seen in and around Suffolk & North Essex. There is always a risk of fire on farms but high temperatures, lack of rain and harvest activity make the risk greater.

Here's a reminder of the key things of which to be aware:

If you discover a wildfire on open land, advice from the emergency services is:

All farms are required to carry out a fire risk assessment. If you employ five or more people there is a requirement to record significant findings. At Longfields, we are pleased to discuss complete farm risk management plans and a call to us may help you consider your current position.

At harvest, to reduce the risk of fire:

Every year sees arson attacks involving stacks. You can reduce risk by:

John Whyman

01206 396000

www.longfields.co.uk

Longfields Barn, Stanaway Farm

Charity Lane, Otley, IP6 9NA

Ipswich: 01473 784500

Colchester: 01206 396000

info@longfields.co.uk