As the cost-of-living soars, why not let your business take the strain when it comes to protecting your loved ones?

In this blog, written by Independent Financial Adviser Neil Walker, Neil looks at how your business could take the strain as cost-of-living rises.

As interest rates rise and the cost of living seems to increase daily, finding ways to save money are more important than ever. This is certainly the case for small business owners who, more than most, are feeling the pinch of the cost of living from both the professional as well as the personal side of life.

As more of the population are now working for themselves via their own limited companies, many small businesses are missing out on the tax savings available by letting their business provide for their families by way of life cover through an underutilised and often overlooked product called Relevant Life.

Relevant Life is a tax efficient way for businesses to offer life insurance (death in service benefits) to their employees on an individual basis. In the case of many small businesses, such employees will also include the business owners such as Managing Directors as well as other family members. It therefore allows the business to take advantage of the tax efficiency usually enjoyed by larger companies with larger workforces.

In simple terms the employer provides an individual life cover policy for an employee that pays out a lump sum if the life covered dies during the policy term. The employer being the policyholder, the employee being the life insured with the policy being written in trust to provide the benefit for the employee’s chosen beneficiaries.

As Relevant Life is written on an individual basis, small business owners can take advantage of the tax efficiencies generally enjoyed by large companies by covering themselves should they be employed by their own limited company.

Please note that the provision is for an employee or employed Director so this style of provision is not suitable for self-employed or partners.

- An employer takes out a policy on an employee’s life.

- The policy is put in trust for the beneficiaries.

- If the employee dies the trustees claim and pay out to the beneficiaries.

From the employer’s perspective, the premium is employer funded and therefore there are no national insurance contributions on them. As the premiums are a business expense, they reduce profitability and therefore potentially gain Corporation Tax Relief.

- Benefits are not taxed as employment income.

- No National insurance contributions on premium as they are employer funded.

- As the benefits are in trust, they are not included in their estate for inheritance tax purposes.

- For higher earners, unlike many employer provided Life Schemes, Relevant Life plan benefits do not count towards pension annual or lifetime allowances.

The benefits of purchasing life cover via relevant life are best seen when looking at the net cost of purchasing life cover for an employee through the relevant life plan when compared to a standard individually purchased life cover policy.

Worked Example

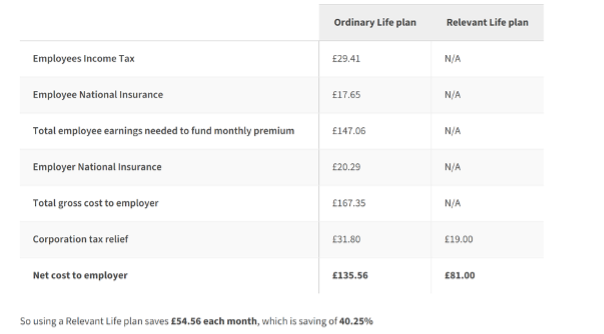

Assuming a £100 monthly premium for an employed Director of a limited company (basic rate tax payer).

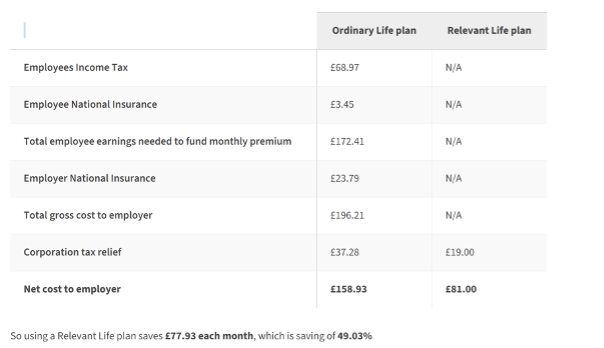

The results are even more pronounced for a high-rate tax payer as follows:

- The output is purely for illustrative purposes and is based on the information and figures you provide. Aviva accepts no responsibility for errors, inaccuracies, omissions or inconsistencies in the output or for any decisions or actions taken as a result

- Tax and National Insurance calculations are based on our understanding of current legislation and tax rates. They assume that the same rates of Income Tax and National Insurance apply to the whole of the premium

- The Employer's Corporation Tax rate is based on 19%

- The Employer's National Insurance rate is based on 13.8%

- Tax treatment will depend on individual circumstances and tax rules may change in the future

The benefits of Relevant Life can offer large savings to many employees and small business owners and are certainly well worth exploring as part of both personal and business financial arrangements. As with many areas of financial advice, there are many providers offering different options for Relevant Life protection. In order to gain the best policies for your needs I would strongly recommend the use of a professional and independent financial adviser.

If you are concerned about the provision for loved ones as well as ongoing costs, Relevant Life may offer peace of mind as well as the savings needed to help with these uncertain inflationary times.

If you wish to discuss Relevant Life with Neil or would like to talk about your financial planning, please speak with your Longfields Account Manager, who will put you directly in touch with Neil.

2plan wealth management Ltd is authorised and regulated by the Financial Conduct Authority. It is entered on the FCA register (www.fca.org.uk ) under reference 461598.

Registered office: 2plan wealth management Ltd, 3rd Floor, Bridgewater Place, Water Lane, Leeds, LS11 5BZ.

Registered in England Number: 05998270